On January 7, 2026, Donald Trump reignited the defense debate in Washington with a staggering proposal: increase military spending to a record-breaking $1.5 trillion by 2027. Framed as a bold response to rising global threats, the plan signals a dramatic shift with a financial cost that could impact the country for decades.

Russia’s Last Aircraft Carrier Is Falling Apart, Will Moscow Finally Scrap It?

A Historic Leap In Defense Spending

Trump’s proposed 2027 defense budget reflects a 50% jump from the $901 billion approved for 2026, according to AP News. It’s not just an increase, it’s a budgetary surge rarely seen in U.S. history.

The plan aims to modernize the U.S. military, reinforce deterrence, and address growing geopolitical tensions. But the scale of spending raises a critical issue: how will it be funded? The likely answer is through more federal borrowing, in a context where public finances are already under pressure.

$5 Trillion Is Just The Beginning

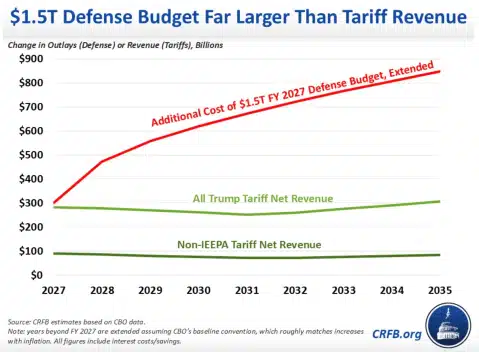

According to the Committee for a Responsible Federal Budget (CRFB), Trump’s proposal would generate $5 trillion in additional defense spending by 2035. That’s about €4.6 trillion based on current exchange rates. But when including interest payments tied to increased debt, the overall financial impact rises to $5.8 trillion, or roughly €5.33 trillion.

“We preliminarily estimate that this would increase defense spending by $5 trillion through 2035, adding $5.8 trillion to the national debt when interest is included,” the CRFB reports.

Tariff Revenues Won’t Fill The Gap

Trump has argued that tariff income could help cover the cost. But as reported by Reuters, an analyst at Moody’s Ratings called that scenario “highly unlikely.” The expert believes these revenues would fall far short, meaning most of the plan would need to be financed by expanding the deficit.

More debt means higher interest costs, further limiting future budget options. With U.S. public debt already exceeding $38 trillion as of early 2026, the pressure on long-term fiscal stability is intensifying.

A Strategic Bet With Economic Consequences

This defense proposal could reshape the U.S. military footprint for the next decade. But it also brings to light a deeper dilemma: how far can the U.S. stretch its defense budget without threatening its financial foundations?

As the election campaign accelerates, markets, credit agencies, and lawmakers will be forced to weigh the costs. This time, the question isn’t just about military readiness. It’s about whether the country can afford the plan at all.